The month of February 2020 is another month of dividend income

landing in my accounts. Recently, I switched my pay yourself first model

to concentrate a little on debt repayment. The interest on debt is

7.16% 6.66% plus the insurance on the debt. During the last week, the Bank of Canada reduced the interest rate by 50bps or 0.50%. I currently pay myself 10% of

income from job(s) and non-registered accounts to my TFSA. The TFSA

income is staying within the account. I will deviate the 10% to savings

account instead of to TFSA if a large expense comes up like a dental

appointment.

Note: All the dividends and totals below are in Canadian Dollars.

Non-registered Accounts

- Bank of Montreal (BMO) - $90.10

- Cineplex (CGX) - $24.00

- Emera Inc. (EMA) - $61.25

- Enerplus (ERF) -$ 5.58

- Shaw Communications (SJR.B) - $19.75

Subtotal : $200.68

TFSA

- A&W Royalties Income Fund (AW.UN) - $6.04

- Boston Pizza Royalties Income Fund (BPF.UN) - $23.97

- Cominar REIT (CUF.UN) - $13.32

- Killam Properties REIT (KMP.UN) - $16.61

- Royal Bank (RY) - $58.80

Subtotal: $118.74

Total = $319.42

I received a total of $319.42 in dividend income for the month

of February 2020. This represents a 2.77% increase from 3 months ago and 39.81% increase year over year.

The increase from 3 months ago is less than 3%. Boston Pizza Royalties Income Fund announced a distribution decrease from $0.115 per unit monthly to $0.102 per unit. This decrease in dividend income was offset by the increase in the payment from Bank of Montreal.

I received dividend / distribution income from 10 different companies.

I received $0.00 in option premiums within my investment accounts in February 2020.

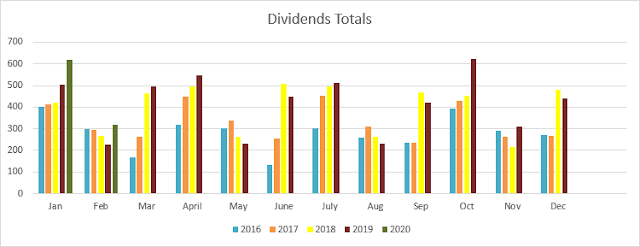

Below is a visual of my dividend totals for the last 5 years.

I will update my dividend income tab with the new amount. I will include

my option premium income also. It is great to see money from passive

income sources deposited into my brokerage account every single month.

How was your dividend income for February 2020?

Disclosure : Long all mentioned securities

DISCLAIMER

I

am not a financial planner, financial advisor, accountant or tax

attorney. The information on this blog represents my own thoughts and

opinions and should NOT be taken as investment or business advice.

Every individual should do their due diligence to make their own financial decisions based on their financial situation and tolerance for risk.

Every individual should do their due diligence to make their own financial decisions based on their financial situation and tolerance for risk.

IP -

ReplyDeleteThat YoY growth is astounding. Further, interest rates are def. interesting right now, no pun intended!

-Lanny

Lanny,

DeleteI added more shares of BMO, RY and CGX over the last year. The first 2 are great investments and known to be some of the best and safest banks in the world. CGX is getting bought out by Cineworld of the UK in the first half of 2020. Unless, Cineworld backs out due to fears over the conoravirus, the deal should go ahead as shareholders of both companies have voted in favor of the takeover.