The month of September had another Bank of Canada announcement. The Bank of Canada held the interest rate of 5.00%. The premiers of Ontario and British Columbia urged the Bank of Canada to not to increase the rate has so many people are struggling with higher inflation and mortgage payments.

During the month of September the federal Liberal government threatened the big 5 grocery store chains (Walmart, Costco, Metro, Loblaws, Empire) to stabilize or lower prices or the government will take action such as a grocery tax. This was to be done by Thanksgiving weekend. In Canada, Thanksgiving occurs on October 9.

The grocery store chains sent representatives to Ottawa to discuss with the government steps to address the ever increasing prices.

The S&P500 was down 3.34% over the past month.

The S&P TSX Composite Index was down 4.13% over the past month.

Portfolio Activity

Margin Account Activity

There has been no activity in this account since the last update.

TFSA Activity

On September 25, I added to my position in A&W Royalties Income Fund. The ticker symbol is AW.UN and is traded on the Toronto Stock Exchange.

I purchased 70 units at $32.10 for a total cost of $ 2252.20. A&W Royalties Income Fund pays a distribution of $0.16CAD per unit monthly, or $1.92CAD per unit quarterly. The yield on cost for this purchase is 5.97%.

This purchase adds $134.40 to my annual dividend income.

Shares Purchased Via DRIP

2 unit of ERF.TO @ $24.0635 for a total cost of $48.13 (Margin)

1 unit of KMP.UN @ $18.67869 for a total cost of $18.68 (TFSA)

6 shares TTNM.TO @ $2.6641 for a total cost of $15.98 (TFSA)

1 share of MFC.TO @ $26.14332 for a total cost of $26.14 (TFSA)

1 unit of BPF.UN @ $15.27435 for a total cost of $15.27 (TFSA)

2 units of BEP.UN @ $21.007USD for a total cost of $57.04CAD (TFSA)

4 shares of T.TO @ 21.38807 for a total cost of $85.55 (TFSA)

1 share of QSR.TO @ $64.1291USD for a total cost of $87.92CAD (Margin)

Enerplus (ERF.TO) pays a dividend of $0.06USD per share monthly, or $0.24USD per unit annually. This drip adds $0.48USD to my annual dividend income. At the time of this writing, the Canadian dollar equivalent is $0.66CAD. Using the Canadian dollar equivalent, the yield on cost for this DRIP is 1.36%.

Killam Properties REIT pays a distribution of $.058333 CAD per unit monthly, or $0.70 CAD per unit annually. This drip adds $0.70 CAD to my annual dividend income. The yield on cost for this drip is 3.75%.

Titanium Transportation Group (TTNM.TO) pays a dividend of $0.02CAD per share quarterly, or $0.08CAD per share annually. This drip adds $0.48 CAD to my annual dividend income. The yield on cost for this DRIP is 3.00%.

Manulife Financial (MFC.TO) pays a dividend of $0.365 CAD per share quarterly, or $1.46 CAD per share annually. This drip adds $1.46 CAD to my annual dividend income. The yield on cost for this DRIP is 5.59%.

Boston Pizza Royalties Income Fund (BPF.UN.TO) pays a distribution of $0.107 CAD per unit monthly, or $1.284 CAD per unit annually. This drip adds $1.28 CAD to my annual dividend income. The yield on cost for this DRIP is 8.41%.

Brookfield Renewables Partners LP (BEP.UN) pays a distribution of $0.3375 USD per unit quarterly, or $1.35USD per unit annually. This drip adds 2.70USD to my annual dividend income. At the time of this writing, this is equivalent to $3.69 in Canadian dollars. The yield on cost, using the Canadian dollar equivalent, is 6.48%.

Telus (T.TO) pays a dividend of $0.3636 CAD per share quarterly, or $1.4544 CAD per share annually. This drip adds $5.82 CAD to my annual dividend income. The yield on cost for this DRIP is 6.80%.

Restaurant Brands International (QSR.TO) pays a dividend of $0.55USD per share quarterly, or $2.20 USD per share annually. This drip adds $2.20 USD to my annual dividend income. At the time of this writing, the Canadian dollar equivalent is $3.01CAD. Using the Canadian dollar equivalent, The yield on cost for this DRIP is 3.42%.

I have some other positions with the DRIP turned on but might not have enough of a dividend to purchase a whole share.

My Enbridge position directly with the transfer agent is set up to DRIP. Around November 2018, Enbridge stopped their DRIP program. If Enbridge decides to start a DRIP, then my shares will start to DRIP again automatically.

Dividend Increases

On September 19, Fortis Inc. increased their dividend from $0.565 CAD to $0.59CAD quarterly, or from $2.26CAD from $2.36CAD annually. This is an increase of 4.42% .

I currently own 123 shares of Fortis. This increase adds $12.30 CAD to my annual dividend income.

On September 20, Emera Inc. increased their dividend from $0.69 CAD to $0.7175CAD quarterly, or from $2.76CAD from $2.87CAD annually. This is an increase of 3.98% .

I currently own 127 shares of Emera. This increase adds $13.97 CAD to my annual dividend income.

Dividend Decreases

There were no dividend decreases in September 2023.

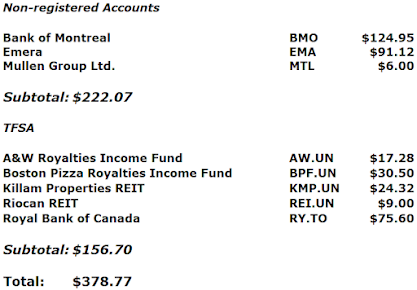

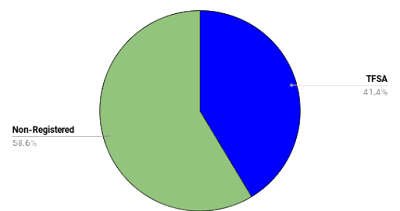

Summary:

As of October 7 , 2023, the total value of the portfolio is $190625.10 . This is a 5.31% decrease over last month's total.

The portfolio is estimated to produce an estimated $8980.30CAD in dividend income over the next 12 months. This is an increase of $192.09 CAD , or 2.19%. Some of the dividends in the Canadian stocks section are paid in US dollars, which are converted to Canadian dollars.

Googlesheets is still not operating properly. So, I had to manually enter the market value for the REITS, BEP.UN, BPF.UN, and AW.UN.

Please Note: Positions in Enerplus Corporation (ERF.TO), Restaurant Brands International (QSR.TO) , Intertape Polymer Group (ITP.TO), Brookfield Renewables Corporation (BEPC.TO), and Algonquin Power and Utilities (AQN.TO) pay dividends in US dollars. Brookfield Renewables Partners (BEP.UN) pays distributions in US dollars. My investment tab spreadsheet displays the Canadian dollar equivalent within 15 to 20 minutes of real time.

Disclosure: Long aforementioned stocks

DISCLAIMER

I am not a financial planner, financial advisor, accountant or tax attorney. The information on this blog represents my own thoughts and opinions and should NOT be taken as investment or business advice. Every individual should do their due diligence to make their own financial decisions based on their financial situation and tolerance for risk.ir financial situation and tolerance for risk.

.png)