Covid is still in the news with doctors and parents of school age kids calling for mask mandates in all indoor public places. The politicians have not made the move yet saying things like we have to learn to live with Covid or recommend people to wear masks.

In Canada, the weather has been real cold as of late. In the lower mainland of British Columbia, there has been snow, freezing rain and pools of water on road ways. There is possible high risk of flooding in the British Columbia's lower mainland. Some major bridges in Vancouver had to be closed to ice build up on the suspension cables.

While the federal government saying 20% of vehicles by 2026 manufactured will be electric. Shortly around this time, Alberta as asked people to reduce their power usage. So, when it gets really cold, the electricity grid is struggling to keep up with demand. How will the grid handle the demand for electricity that comes from recharging electric vehicles?

The NDP's leader is threatening to break the agreement with the Liberal government over healthcare. Currently, the healthcare in Canada is in bad shape. The Prime Minister came out and said that just handing out more money will not fix or alleviate problems with the healthcare system across Canada. Could the the government fall in early 2023 leading to another federal election.

There are predictions we will be in a recession in 2023.Let's get to the list of dividend income from some Canadian bloggers for November 2022. Of course, I first want to mention my own dividend income report.

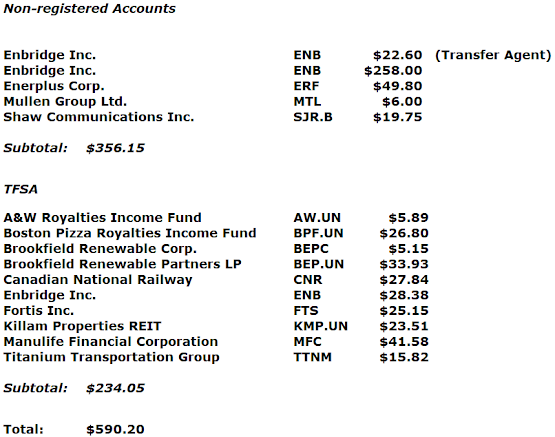

Passive Canadian Income received $1592.64 in passive income for the month of November 2022. Of this total, $469.91 was dividend income. The number of new shares / units dripped came in at 1.

Reverse The Crush received $102.92 in dividend income in November 2022. This is a 55% YoY increase.

All About the Dividends received $644.71 in dividend income and added over $26.69 in forward dividend income via DRIPs.

Our Life Financial received $1332.64 in dividend income. Combined with her husband, they received $1565.88 in total dividend income and 26.65% increase YoY.

Moneymaaster received $742.49 in dividend income and dripped 40 new shares/units to boost his future dividend income.

My Own Advisor and Gen Y Money shared their individual dividend income updates with the world. Although their actual amount of dividend income received in November 2022 is not mentioned, there is some great information in their respective posts.

Tawcan received $2833.05 in dividend income in November 2022 and dripped 25 shares.

Fire We Go (via video) received $2139.73 in dividend income for the month of November 2022

Conclusion:

We all started with $0.00 of passive income and have grown our investments over time. Each "BUY" transaction can provide ongoing dividend income which may also be increased over time.

In Canada and the United States, many brokerage accounts offer commission free trades and/or commission free ETFs. You can get started on your investing journey with very little money.

DISCLAIMER

I am not a financial planner, financial advisor, accountant or tax attorney. The information on this blog represents my own thoughts and opinions and should NOT be taken as investment or business advice.

Every individual should do their due diligence to make their own financial decisions based on their financial situation and tolerance for risk.

.png)

.png)