Note: All the dividends and totals below are in Canadian Dollars.

Non-registered Accounts

Bank of Montreal (BMO) - $90.10

Emera Inc (EMA) - $63.75

Enerplus (ERF) - $7.43

Shaw Communications (SJR.B) - $19.75

Subtotal : $181.03

TFSA

A&W Royalties Income Fund (AW.UN) - $3.80

Boston Pizza Royalties Income Fund (BPF.UN) - $15.67

Cominar REIT (CUF.UN) - $6.84

Killam Properties REIT (KMP.UN) - $17.11

Royal Bank of Canada (RY) - $60.48

Subtotal: $103.90

Total = $284.93

I received a total of $284.93 in dividend income for the month of November 2020. This represents a 4.19% increase from 3 months ago and 8.32% decrease year over year.

The decrease year over year was due to dividend cuts. Cineplex, which paid monthly, has stopped paying a dividend for a few reasons. As Cineplex deal to be bought out did not get completed, Cineplex has been hit extremely hard due to COVID19 health pandemic. Boston Pizza Royalties Income Fund suspended their dividend from several months and then started to pay a monthly dividend again, albeit at a lower amount.

I received dividend / distribution income from 9 different companies.

I received $0.00 in option premiums within my investment accounts in November 2020.

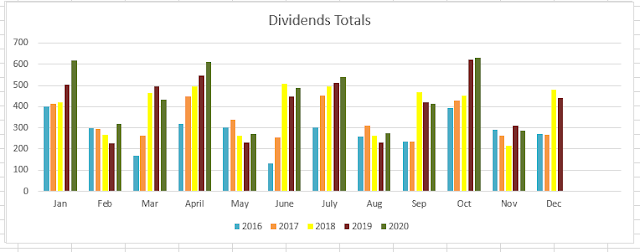

Below is a visual of my dividend totals for the last 5 years.

Most of my dividend income comes from my margin account.

Next, I will show the percentage of total income for each position.

|

| Click to Enlarge |

I will update my dividend income tab with the new amount. I will include my option premium income also. It is great to see money from passive income sources deposited into my brokerage account every single month.

Note: Any activity in my RRSP account is not included in these totals.

How was your dividend income for November 2020?

Disclosure : Long all mentioned securities

DISCLAIMER

I am not a financial planner, financial advisor, accountant or tax attorney. The information on this blog represents my own thoughts and opinions and should NOT be taken as investment or business advice.

Every individual should do their due diligence to make their own financial decisions based on their financial situation and tolerance for risk.

nice pursuit. Great month with some chunky bank payments.

ReplyDeleteLove that pie view as well.

keep it up

cheers

RY and BMO accounted for over 50% of the month's today. Great companies that are very safe investments.

DeleteThe pie view adds something different to the posts. I have to do re-arranging of the list when more companies paid out to get them all to show up.

Excellent month, Investing Pursuits! Even with the decrease, that's a nice chunk of cash flow. Some of the cuts and slashes affected my portfolio in 2020 too.

ReplyDeleteMy dividend income for November was decent. I had small growth. We both got paid by $RY. Looking forward to 2021 reports! :)

RTC,

DeleteThanks for dropping by. I am actually surprised A&W Royalties Income Fund and Boston Pizza Royalties Income Fund did not cut their distribution again as were are in the second wave of COVID19.

Surprisingly, A&W paid a $.30 special distribution recently and have paid a second special distribution $0.20 per unit at the end of December. Boston Pizza Royalties Income Fund will pay a special distribution in January. This is on top their regular distribution.