The month of January 2023 is now behind us.

The price of food, gasoline, and utilities remain high. On January 31, Loblaws ended their price freeze on no-name products. Some of the products basically disappeared from the grocery store shelves during the price freeze. Also, I noticed some prices were increased prior to the end of the month.

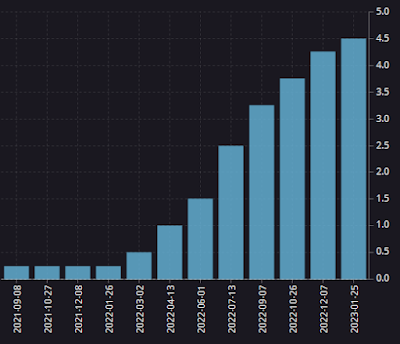

The Bank of Canada has raised the interest rate by 25bps. The overnight rate is now 4.50%. This has been the 8th increase in less than 365 days.

|

| (Source: Policy interest rate - Bank of Canada) |

By raising the interest rate, the Bank of Canada is trying to lower the rate of inflation and slow down the economy. When the interest rate is increased, the banks raise their interest rates on loans and mortgages. The cost of borrowing money means people have less disposable income.

Many provinces across Canada, has provided help to people such as removing the provincial fuel tax, electricity rebates, give money to families that have children etc.

The Rogers Communications take over of Shaw Communications is one step closer to be done. The companies have extended their deadline to February 17th.

People still believe we are going to see a recession in 2023. How bad of a recession we will have varies from one investment professional to another.

Portfolio Activity

Margin Account Activity

There was no activity in the account during the month of January 2023.

TFSA Activity

There was no activity in the account during the month of January 2023. I am currently adding money to this account through paying myself first.

Shares Purchased Via DRIP

1 unit of BPF.UN.TO @ $16.57742 for a total cost of $16.58 (TFSA)

1 unit of KMP.UN @ $17.91 for a total cost of $17.91 (TFSA)

0.992503 shares of BNS.TO @ $71.1836 for a total cost of $70.65 (Transfer agent)

7 shares of AQN.TO @ $6.69999 USD for a total cost of $62.70 CAD (TFSA)

1 share of QSR.TO @ $65.1268 USD for a total cost of $89.03 CAD (Margin Account)

Boston Pizza Royalties Income Fund (BPF.UN.TO) pays a distribution of $0.102 per unit monthly, or $1.224 per unit annually. This drip adds $1.22 CAD to my annual dividend income. The yield on cost for this DRIP is 7.38%.

Killam Properties REIT pays a distribution of $.058333 per unit monthly, or $0.70 per unit annually. This drip adds $0.70 CAD to my annual dividend income. The yield on cost for this drip is 3.91%.

Bank of Nova Scotia (BNS.TO) pays dividend of $1.03 CAD per share quarterly, or $4.12 CAD per share annually. This drip adds $4.09 CAD to my annual dividend income. The yield on cost for this DRIP is 5.83%.

Algonquin Power and Utilities pays a dividend of $0.1085 USD per share quarterly, or $0.434 USD per share annually. This drip adds $3.04 USD to my annual dividend income. At the time of this writing, this is equivalent to $4.08 CAD. The yield on cost, using the Canadian dollar equivalent, for this DRIP is 6.50%.

Restaurant Brands International (QSR.TO) pays a dividend of $0.54 USD per share quarterly, or $2.16 USD per share annually. This drip adds $2.16 USD to my annual dividend income. At the time of this writing, this is equivalent to $2.90 CAD. The yield on cost, using the Canadian dollar equivalent, for this DRIP is 3.25%.

I have some other positions with the DRIP turned on but might not have enough of a dividend to purchase a whole share.

My Enbridge position directly with the transfer agent is set up to DRIP. Around November 2018, Enbridge stopped their DRIP program. If Enbridge decides to start a DRIP, then my shares will start to DRIP again automatically.

Dividend Increases

Dividend Increases

On January 24, Canadian National Railway (CNR.TO) increased their dividend from $0.7325 CAD to $3.16 CAD quarterly, or from $2.93 CAD to $3.16 CAD per share annually. This is an increase of 7.85%.

At the time of the press release, I own 38 shares of Canadian National Railway. This increase adds $8.74 to my annual dividend income.

Dividend Decreases

On January 12, Algonquin Power and Utilities (AQN.TO) decreased their dividend from $0.1808 USD to $0.1085 USD per quarter, or from $0.7232 USD to $0.434 USD annually. This is a decrease of 40%.

The annual dividend has been reduced by $0.2892 USD. At the time of this writing, this is equivalent to $0.3878 in Canadian dollars.

At the time of writing, I currently own 285 shares of Algonquin Power and Utilities. This decrease reduces my annual dividend income by $110.52 CAD.

Summary:

As of February 4, 2022, the total value of the portfolio is $194662.63. This is a 5.54% increase over last month's total.

The portfolio is estimated to produce an estimated $7774.45 in dividend income over the next 12 months. This is a decrease of $89.67CAD , or 1.140%. Some of the dividends in the Canadian stocks section are paid in US dollars, which are converted to Canadian dollars.

Please Note: Positions in Enerplus Corporation (ERF.TO), Restaurant Brands International (QSR.TO) , Intertape Polymer Group (ITP.TO), Brookfield Renewables Corporation (BEPC.TO), and Algonquin Power and Utilities (AQN.TO) pay dividends in US dollars. Brookfield Renewables Partners (BEP.UN) pays distributions in US dollars. My investment tab spreadsheet displays the Canadian dollar equivalent within 15 to 20 minutes of real time.

Disclosure: Long aforementioned stocks

DISCLAIMER

I am not a financial planner, financial advisor, accountant or tax attorney. The information on this blog represents my own thoughts and opinions and should NOT be taken as investment or business advice. Every individual should do their due diligence to make their own financial decisions based on their financial situation and tolerance for risk.

No comments:

Post a Comment