The month of October 2024 is another month of dividend income landing in my accounts.

Update on paying myself first. At the start of August 2022, I now pay myself 35%. This will consist of 25% to investing and 10% to savings.

At the start of January 2024, I allocated 27% to investing and 10% to savings.

Starting July 2024, I started allocating 30% to investing and 10% savings.

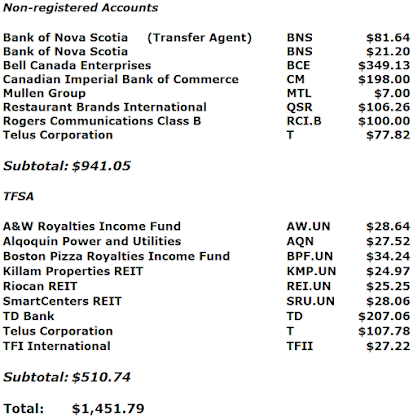

Note: All the dividends and totals below are in Canadian Dollars

Note: All the dividends and totals below are in Canadian Dollars

I received a total of $1451.79 in dividend income for the month of October 2024. This represents a 0.187% increase from 3 months ago and a 53.6% increase year over year.

I received dividends from 2 US stocks. Chord Energy dividend was in actual US dollars. The value above in the Canadian Dollar equivalent of the US dividend (minus the 15% withholding tax) using the exchange rate on the actual day the dividend hit my account. For Meta Platforms, my brokerage converted the US dividend (minus the 15% withholding tax) to Canadian dollars.

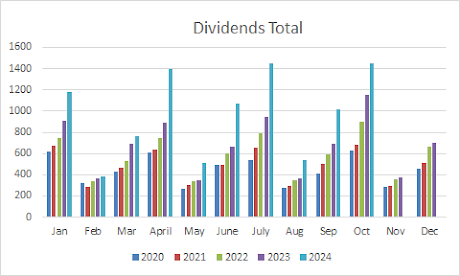

Below is a visual of my dividend totals for the last 5 years.

Note: Any activity in my RRSP account is not included in these totals.

How was your dividend income for October 2024?

Disclosure : Long all mentioned securities

DISCLAIMER

I am not a financial planner, financial advisor, accountant or tax attorney. The information on this blog represents my own thoughts and opinions and should NOT be taken as investment or business advice.

Every individual should do their due diligence to make their own financial decisions based on their financial situation and tolerance for risk.

I received dividend / distribution income from 15 different companies.

I received $0.00 in option premiums within my investment accounts in October 2024.

I received $0.00 in option premiums within my investment accounts in October 2024.

Below is a visual of my dividend totals for the last 5 years.

|

| Ckick To Enlarge |

Most of my dividend income comes from my margin account. As more investments and DRIPs are made inside TFSA, the percentage of dividend income for the TFSA is increasing.

|

| Click To Enlarge |

Next, I will show the percentage of total income for each position. For the positions and their corresponding percentages missing from the chart below, Riocan REIT (REI.UN) made up 1.8% and Mullen Group (MTL.TO) made up 0.5% of the dividend income.

In first ten months of 2023, I received $7024.46 in dividends. In first ten months of 2024, I received $9755.61 in dividends. This is an increase of 38.88% YTD in 2024 over the same period in 2023.

The graph below shows my total dividend income, as per the blog, since 2012.

|

| Click To Enlarge |

I will update my dividend income tab with the new amount. I will include my option premium income also. It is great to see money from passive income sources deposited into my brokerage account every single month.

Note: Any activity in my RRSP account is not included in these totals.

How was your dividend income for October 2024?

Disclosure : Long all mentioned securities

DISCLAIMER

I am not a financial planner, financial advisor, accountant or tax attorney. The information on this blog represents my own thoughts and opinions and should NOT be taken as investment or business advice.

Every individual should do their due diligence to make their own financial decisions based on their financial situation and tolerance for risk.