On January 25, the Bank of Canada raised the interest rate by 0.25bps to 4.5%. As usual, the big banks quickly raised their prime rate shortly after the Bank of Canada's interest rate hike.

The Bank of Canada Governor as stated that the rate hike will be the last one for a while. The effect of rate hikes take a while to go through the system. This will hit home for a lot of people with mortgages on variable rate or when it comes time to renewal.

We are likely to experience a recession in 2023, and interest rates will likely not decrease in 2023.

At the end of January, Loblaws removed the price freeze on their No Name products. From what I seen at the grocery store, the prices were raised before this date. This just adds more fuel to the inflation crisis we are all experiencing.

I do 99% of my grocery shopping at Loblaw's stores (No Frills and Super Store) and noticed some of their No Name products have not been on the shelves for months.

The Rogers takeover of Shaw has not yet been completed and the date to complete the merger keeps getting extended. This has been going on for about 2 years.

Let's get to the list of dividend income from some Canadian bloggers for Jnauary 2023. Of course, I first want to mention my own dividend income report.

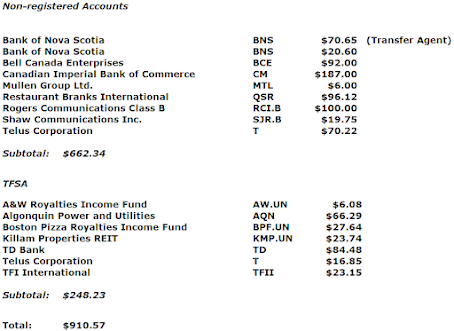

Passive Canadian Income received $2640.34 in passive income for the month of January 2023. Of this total, $848.52 was dividend income. The number of new shares / units dripped came in at 41.

Reverse The Crush received $95.05 in dividend income in January 2023. This is a 5% YoY increase.

All About the Dividends received $718.37 in dividend income in the first month of 2023, while adding over $30.15 in forward dividend income via DRIPs .

Moneymaaster received $2197.21 in dividend income and dripped 106 new shares/units to boost his future dividend income.

My Own Advisor and Gen Y Money shared their individual dividend income updates with the world. Although their actual amount of dividend income received in January 2023 is not mentioned, there is some great information in their respective posts.

Labour to Leisure received $437.16 in dividend income in January 2023. He also dripped 14 additional shares.

Fire We Go (via video) received $3405.42 in dividend income for the month of January 2023.

Conclusion:

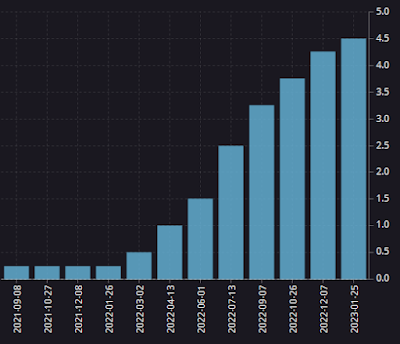

We all started with $0.00 of passive income and have grown our investments over time. Each "BUY" transaction can provide ongoing dividend income which may also be increased over time.

In Canada and the United States, many brokerage accounts offer commission free trades and/or commission free ETFs. You can get started on your investing journey with very little money.

DISCLAIMER

I am not a financial planner, financial advisor, accountant or tax attorney. The information on this blog represents my own thoughts and opinions and should NOT be taken as investment or business advice.

Every individual should do their due diligence to make their own financial decisions based on their financial situation and tolerance for risk.