Today is December 25, 2024. Although passive income through dividends and option premiums is my focus when it comes to investing, I decide to do a post about my current net worth.

Assets

Savings

The savings section is currently into 3 segments. The 3 parts are a "high" interest savings account, novice savings account, savings account, and an "investment" savings account.

The TFSA savings account was with Tangerine. I was frustrated with getting such a low interest rate with Tangerine. I took the money out and placed it in non-registered high interest rate savings account with EQ Bank. Unfortunately, the account did not disappear as interest was earned in the TFSA with Tangerine for the month I transferred the balance. The balance is $0.18. With a value this low, I do not even earn interest as the balance so low.

On December 25, 2024, the value of the savings account with EQ Bank is $11688.12 . As of the time of this writing, the interest rate for EQ Bank is currently sitting at 1.75%. Since the last net worth update, the Bank of Canada cut the interest rate two times. The interest rate was cut by 0.50%, or 50bps, on October 23, 2024. The interest rate was then cut by another 0.50%, 50bps, on December 11, 2024.

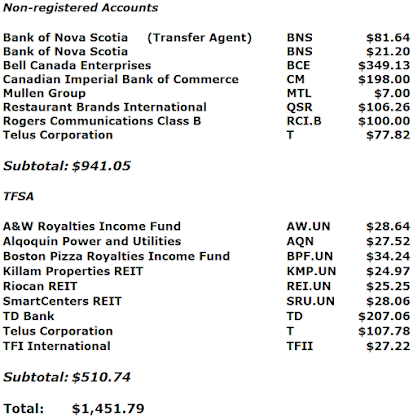

The non-registered accounts consist of a margin account and 2 stocks held directly with the transfer agents. The margin account is with Questrade. The total market value is $135409.68 as of December 25, 2024. This is an increase of 3.42% since the last published net worth post.

The TFSA investing account balance is $122893.68 as of December 25 2024. This account is with Questrade. This is an increase of 1.32% since the last published net worth post.

Trading Account

The trading account is with Questrade. There is an active trade on this account. I also sold a few covered calls on this position, and the most recent covered call expired worthless on December 20th of this month. As of December 25 2024, the value of this account is $6229.48

RRSP

As of December 25, 2024, I own 21 shares of CP Rail (Ticker Symbol CP.TO) , 152 units of XAW, 65 shares of CN Rail (CNR.TO) and 49 shares of Alimentation Couche-Tard (ATD.B.TO)

Total Savings : $16190.30

Non-Registered accounts : $135409.68

Trading Account: $6229.48

RRSP Savings Account: $26022.97

Total Assets =$306746.11 (decrease of 3.00% from 3 months ago)

Liabilities

The balance on my line of credit is $0.00.

Conclusion

On December 25, 2024, my net worth is $294957.94. This is an decrease of $2859.97, or 0.960%, from 3 months ago.

The market continues to go up and down. During the last 3 months, we have seen inflation going down, but the fears of a recession continue to take hold.

Disclosure: - Long all aforementioned stocks

DISCLAIMER

I am not a financial planner, financial advisor, accountant or tax attorney. The information on this blog represents my own thoughts and opinions and should NOT be taken as investment or business advice.

Every individual should do their due diligence to make their own financial decisions based on their financial situation and tolerance for risk.