As previously stated on this blog, that I have started a trading account with a balance below $1000.00. I started to add $50.00 every two weeks but that has stopped due to a recent job loss. The following table shows my stats from the start of 2016:

# of trades : 52

Total Capital added: $250.00Trading Acct Balance: $4061.99

Average Drawdown: $149.14

Average Loss: $287.20

Average Accuracy: 84.62%

Average Risk: $162.37

Average Reward: $111.37

Average Risk/Reward : 1: 0.686

I have been trading penny stocks, stocks, REITS and options. Any dividends that will be received from this account will stay within the account. The accuracy rate is high. Does this mean that I am a super trader? No it does not. The risk to reward ratio states of every $1.00 of risk there is reward of $0.686. Ideally, a trader should aim for a 1:2 risk to reward ratio which causes the accuracy rate to be lower. I lost big on a trade as I did not put a stop in at the initiation of the PZA.TO trade. The stock kept dropping and dropping, so I felt it was best to sell.

The drawdown above is inter-trade drawdown. This type of draw down is the dollar amount the trade moves against you. Why is it important to keep track of inter-trade drawdown? It helps you know if you are picking good entry points. It is normal for trades to have inter-trade drawdown.

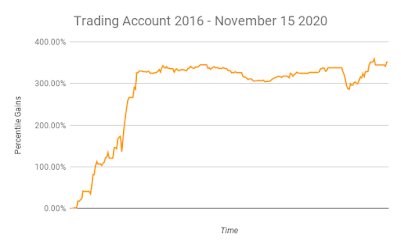

Below is a chart of my 2020 percentile gains

Below is a chart showing my overall percentile gains from January 1, 2016, to November 15, 2020.

Conclusion:

I have not gotten the results that I have wanted over the last couple of years. This is evident in the long roughly flat line in the chart above.

I need to gain better entry points and to make sure to use a stop loss. In the trading platform for my brokerage, you can put in a stop limit order when purchasing a stock via a bracket order.

Note: The trades are listed under the Trading Tab above with all the trades listed as of November 15, 2020

Note: As of November 15, 2020, there is no active trades.

DISCLAIMER

I am not a financial planner, financial advisor, accountant or tax attorney. The information on this blog represents my own thoughts and opinions and should NOT be taken as investment or business advice.

Every individual should do their due diligence to make their own financial decisions based on their financial situation and tolerance for risk.

Every individual should do their due diligence to make their own financial decisions based on their financial situation and tolerance for risk.

Interesting. That 2020 chart doesn't look so good but that 4 year chart looks pretty good.

ReplyDeleteIf these retail reits drop on the next lockdown Ill be buying more this time around.

cheers

Passivecanadian,

DeleteThanks for dropping by. I was quite aggressive in the early years of the trading account. I was trading gold penny stocks mostly and when the stock moves about $0.30 or so, you can get some relatively good gains really quick. In later years, trades in PZA.TO and MTL.TO took awhile to exit. The latter one dipped a lot during the height of the COVID19 pandemic for several months. s