Starting the beginning of January 2021. I am paying myself 30%. This will consist of 15% to investing, 12% to debt, and 3% to savings. I am treating paying debt as paying myself first, to insure I am actually doing it. If I try to pay down debt after spending money on expenses, I might not get the debt paid off in a reasonable time. I am hoping I can keep this up!

Note: All the dividends and totals below are in Canadian Dollars.

Non-registered Accounts

Bank of Montreal (BMO) - $90.10

Emera Inc. (EMA) - $77.78

Enerplus (ERF) - $7.50

Shaw Communications (SJR.B) - $19.75

Subtotal : $195.13

TFSA

A&W Royalties Income Fund (AW.UN) - $5.13

Boston Pizza Royalties Income Fund (BPF.UN) - $16.38

Cominar REIT (CUF.UN) - $6.84

Killam Properties REIT (KMP.UN) - $17.11

Royal Bank of Canada (RY) - $60.48

Subtotal: $105.94

Total = $301.07

I received a total of $301.07 in dividend income for the month of May 2021. This represents a 5.46% increase from 3 months ago and 11.74% increase year over year.

The increase from 3 months ago was mostly due to adding to my position in Emera Inc.

I received dividend / distribution income from 9 different companies.

I received $0.00 in option premiums within my investment accounts in May 2021.

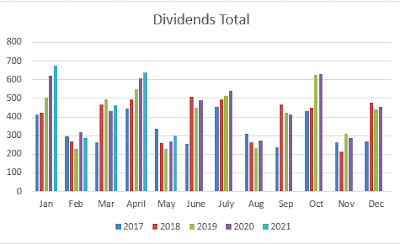

Below is a visual of my dividend totals for the last 5 years.

Next, I will show the percentage of total income for each position.

I will update my dividend income tab with the new amount. I will include my option premium income also. It is great to see money from passive income sources deposited into my brokerage account every single month.

Note: Any activity in my RRSP account is not included in these totals.

How was your dividend income for May 2021?

Disclosure : Long all mentioned securities

DISCLAIMER

I am not a financial planner, financial advisor, accountant or tax attorney. The information on this blog represents my own thoughts and opinions and should NOT be taken as investment or business advice.

Every individual should do their due diligence to make their own financial decisions based on their financial situation and tolerance for risk.

Nice pursuit. I was basically sideways for growth so nice to see you with 11% yr over yr growth.

ReplyDeletekeep it up

cheers

Passivecanadian,

DeleteThanks. I am definitely happy with the growth.