Today is December 25, 2020. Although passive income through dividends and option premiums is my focus when it comes to investing, I decide to do a post about my current net worth.

What is net worth? Simply put, net worth is calculated by adding up all assets and subtracting the total of all liabilities. Net worth is sometimes referred to as shareholder's equity. Assets and liabilities are part of the balance sheet.

Assets

Savings

The savings section is broken into 4 segments. The 3 parts are a "high" interest savings account, savings account, 2 GICs, and an "investment" savings account.

The TFSA savings account was with Tangerine. I was frustrated with getting such a low interest rate with Tangerine. I took the money out and placed it in non-registered high interest rate savings account with EQ Bank. Unfortunately, the account did not disappear as interest was earned in the TFSA with Tangerine for the month I transferred the balance. The balance is $0.18. With a value this low, I do not even earn interest as the balance so low.

On December 25, 2020, the value of the savings account with EQ Bank is $1548.54. As of the time of this writing, the interest rate for EQ Bank is currently sitting at 1.50%. This is down from 1.70% from 3 months ago. The interest rate was cut due to the effects of the COVID19 pandemic on the economy.

This balance would be higher, but I used some cash to purchase 2 GICs of 3 month duration. At the time of purchasing the GICs, the interest rate for the GICs was 1.70% and the same for the savings account.

The first GIC matures on January 6, 2021 and the second matures on January 30, 2021. The GICs are $300 investments with a 1.70% interest rate. The value of these GICs are $600.00. With a GIC, the interest is paid out at maturity.

The stock and ETF investment involves a stock and an ETF that I hold within my margin account. I keep the dividends and distributions received separate from the dividends I post in my dividend income updates.

The stock is Inter Pipeline. The ticker symbol is IPL and trades on the Toronto Stock Exchange. I own 42 shares with an adjusted cost base of $901.80. I received a total of $79.33 in dividends since initiating this position.

I purchased an additional 2 units of BMO High Yield Covered Call ETF at a total cost of $30.37 on October 27. The ticker symbol is ZWC and trades on the Toronto Stock Exchange. My brokerage has zero commissions on purchase of ETFs. There is a small ECN fee which is a few pennies. The purchase of these units resulted in $0.01 in ECN fees. This ETF pays monthly. I received a total of $27.72 in total distributions as of December 25, 2020.

On December 25, the current value of this "stock / ETF account" is $1255.80.

Overall, the savings total is $3404.52

Non-registered Accounts

The non-registered accounts consist of a margin account and 2 stocks held directly with the transfer agents. The margin account is with Questrade. The total value is $82761.69 as of December 25, 2020. This is an increase of 14.17% since the last published net worth post.

TFSA Investing Account

The TFSA investing account balance is $42291.25 as of December 25, 2020. This account is with Questrade. This is an increase of 16.06% since the last published net worth post.

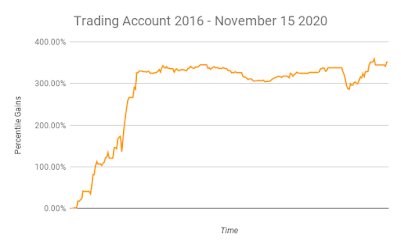

Trading Account

The trading account is with Questrade. There are currently no active trades. As of December 25, 2020, the value of this account is $4128.04.

RRSP

I have transferred my RRSP from Tangerine to Questrade in April 2020. While at Tangerine, the RRSP was in the form of a "high" interest savings account. Now at Questrade, I decided to put the money to work.

As of December 25, 2020, I own 200 shares of Fortis and 45 shares of XAW. I have wrote covered calls on the Fortis position but they have both expired worthless. I have been buying the entire position of XAW using covered call premiums and dividends from the same position in which I sold covered calls.

The value of this account as of December 25 is $13674.99. This is an increase of 2.05% from September 26.

Summary of Assets

Total Savings : $3404.52

Non-Registered accounts : $82761.69

TFSA Investing : $42291.25

Trading Account: $4128.04

RRSP Savings Account: $13674.99

Total Assets = $146260.49 (increase of 13.57% from 3 months ago)

Liabilities

The balance on my line of credit is $2936.61. This is a decrease of $940.55 from 3 months ago. Since I rent and do not have collateral, the interest rate on this account is 5.66%. I get charge an insurance fee when carrying a balance. This insurance fee depends on the balance, therefore it changes every month.

Conclusion

On December 25, 2020, my net worth is $143323.88. This is a increase of $18419.16, or 14.75%, from 3 months ago.

COVID19 is front in center still all across the world. With a few vaccines approved and vaccinations have started in the last week or so, people are starting to some some little light at the end of the tunnel. In Canada, some provinces are experiencing record high COVID19 cases and have started lockdowns.

The US presidential election was November 3rd. This was an election like no other in history. Due to fears of COVID19 spread, there was mail in ballots. There was no way to 100% guarantee a person's identity. How many votes did Donald Trump and Joe Biden actually get that were valid?

To read my first net worth update, click here.

To read the second net worth update, click here.

To read the third net worth update, click here.

To read the fourth net worth update, click here.

Disclosure: - Long IPL, ZWC, XAW, FTS

DISCLAIMER

I am not a financial planner, financial advisor, accountant or tax attorney. The information on this blog represents my own thoughts and opinions and should NOT be taken as investment or business advice.

Every individual should do their due diligence to make their own financial decisions based on their financial situation and tolerance for risk.